Changes Continue in Cyber Insurance

Pure Storage

MARCH 6, 2024

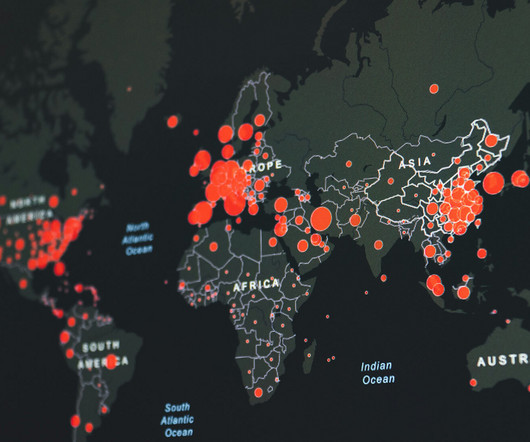

Changes Continue in Cyber Insurance by Pure Storage Blog An ounce of prevention is worth a pound of cure certainly applies to physical health. Prevention begins with having a robust cybersecurity plan in place, along with sufficient insurance to manage risk. But the market is shifting rapidly as cyberattacks continue to spike.

Let's personalize your content