Insurance Crisis in Florida

Recovery Diva

APRIL 2, 2024

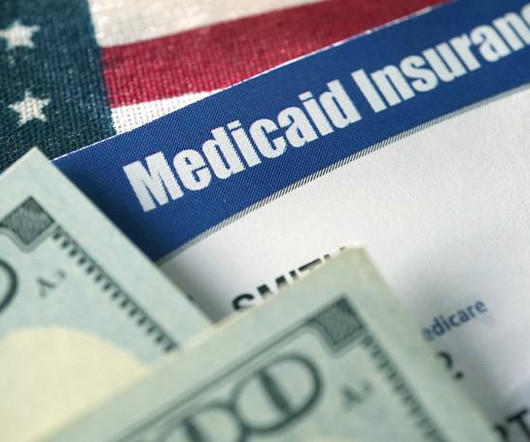

From Newsweek: Florida’s Insurance Crisis Just Got Worse [link] Florida’s insurance saga is deepening as more than 115,000 homeowners in the southwest portion of the state, still reeling from the destruction wrought by Hurricane Ian in 2022, are facing new challenges with a 25 percent increase in flood insurance rates.

Let's personalize your content