The Best Governance, Risk, and Compliance Software to Consider

Solutions Review

SEPTEMBER 27, 2021

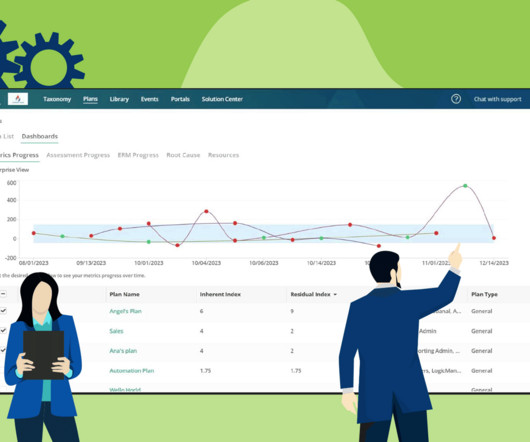

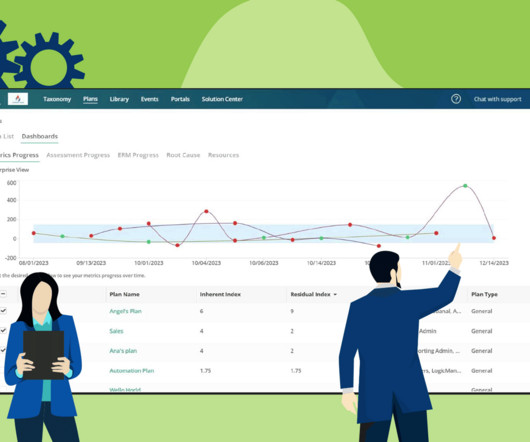

Solutions Review’s listing of the best governance, risk, and compliance software is an annual mashup of products that best represent current market conditions, according to the crowd. To make your search a little easier, we’ve profiled the best governance, risk, and compliance software all in one place. Platform: Enablon.

Let's personalize your content