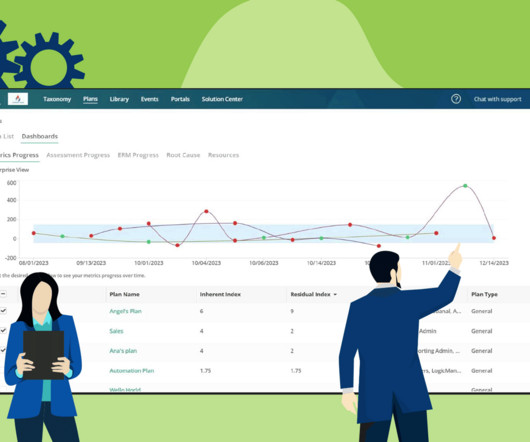

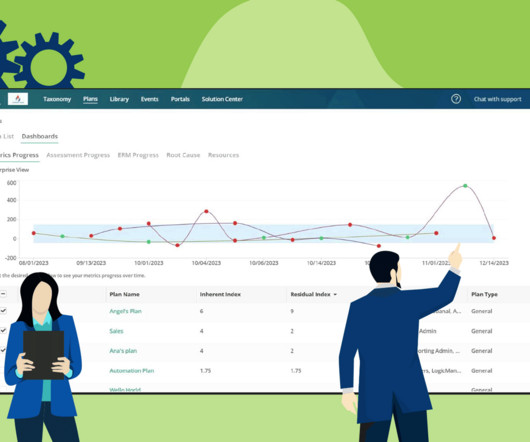

Empowering Strategic Decision-Making with Real-Time Risk Dashboards

LogisManager

DECEMBER 12, 2023

Empowering Strategic Decision-Making with Real-Time Risk Dashboards Published: December 12, 2023 In LogicManager’s latest product update release, powerful new in-app visualizations enable real-time data analysis, fostering informed decision-making and proactive risk strategies for strong corporate governance.

Let's personalize your content