What is the Three Lines of Defense Approach to Risk Management?

Last Updated: October 31, 2023

Recently, the FDIC unveiled new standards for financial institutions with over $10 billion in assets. The proposed standards emphasize a stronger corporate governance and include an over-arching requirement for these banks to adopt the Three Lines Model. While this news is relevant to banks, any organization that values proactive risk identification, effective risk management, and regulatory compliance would benefit from implementing the Three Lines Model to safeguard their operations and reputation. Read on to learn what the Three Lines of Defense are and how you can utilize the framework to improve your risk management program.

What Are the Three Lines of Defense?

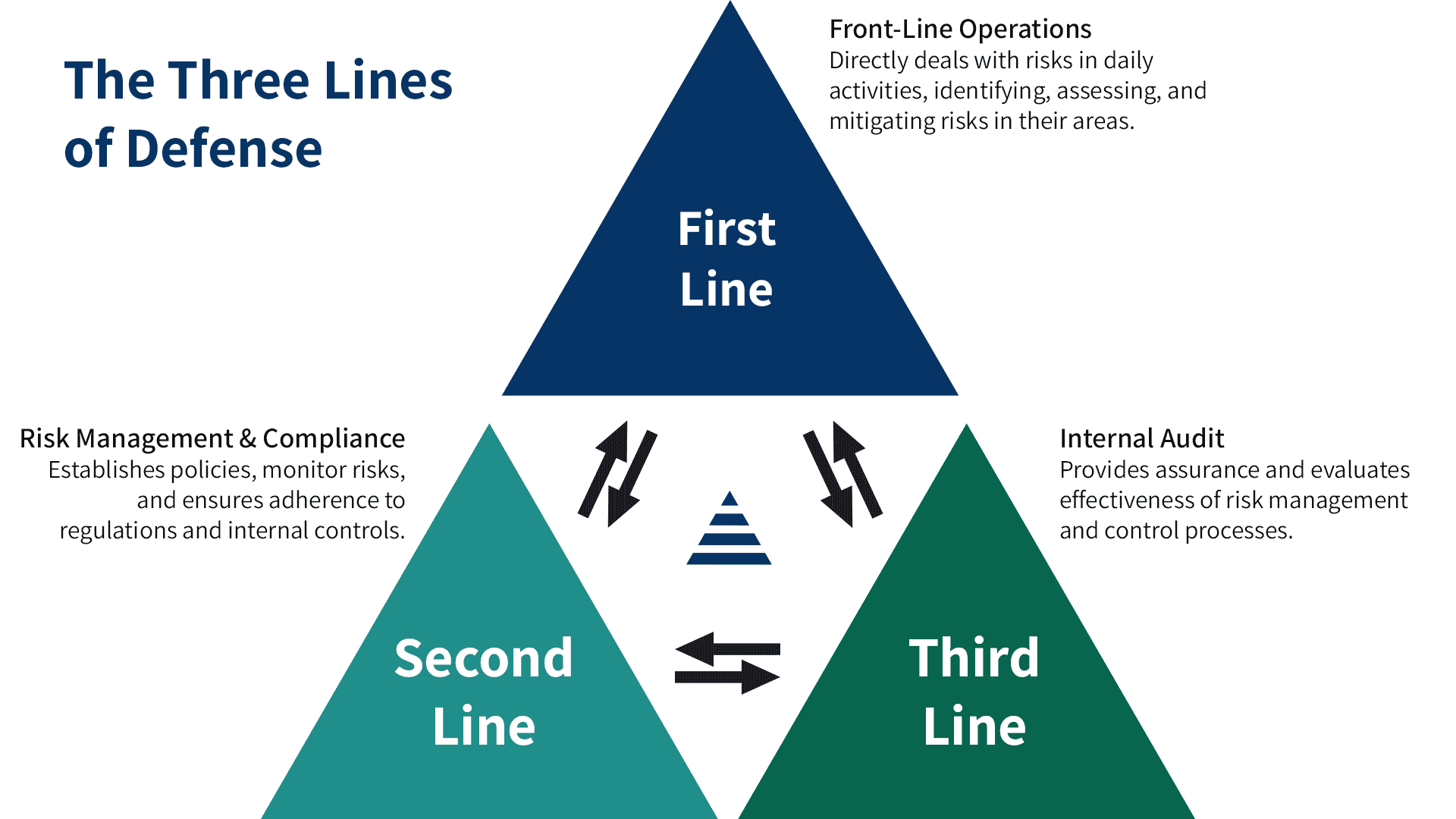

The Three Lines of Defense (3LOD) is a risk management framework created by the Institute of Internal Auditors, commonly used by organizations to help ensure effective risk management and control. It divides responsibilities and functions related to risk management into three distinct lines, each with its own role and purpose:

First Line of Defense

The first line of defense represents the front-line operations of the organization. This includes business units, departments, and individuals directly responsible for managing and executing processes and activities that generate risk. Their primary role is to identify, assess, and manage risks as an integral part of their daily operations. They are the ones who “own” the risk and are responsible for taking actions to mitigate it.

Second Line of Defense

The second line of defense consists of risk management and compliance functions within the organization. This includes risk management, compliance, and internal control departments. Their role is to provide oversight, guidance, and monitoring of the first line’s risk management activities. They set policies, standards, and procedures, conduct risk assessments, and ensure that the first line complies with applicable laws, regulations, and internal policies. The second line serves as a check on the first line’s risk management efforts.

Third Line of Defense

The third line of defense is typically the internal audit function. Internal auditors operate independently from the first and second lines and provide an objective evaluation of the effectiveness of an organization’s risk management and control processes. They review and assess the activities of the first and second lines to ensure that risks are being appropriately managed and that the organization complies with relevant rules and regulations. Their work helps provide assurance to senior management and the board of directors that risk management processes are functioning as intended.

The 3LOD model is a structured approach to risk management that helps ensure accountability, transparency, and efficiency in managing an organization’s risks. By clearly defining the roles and responsibilities of each line, it aims to prevent or detect issues early and improve decision-making related to risk and control. This model is widely used in various industries, including finance, healthcare, and compliance-driven sectors.

The Internal Auditor’s Guide

The Audit guide is a valuable resource for your risk and audit teams to work together to make sure you are meeting the obligations of the board. Use the Audit Guide in conjunction with the Risk Maturity Model to confirm your organization’s ERM program is being measured effectively, accurately, and in alignment with the IIA’s standards.

How Can Organizations Implement the Three Lines Model?

Implementing the Three Lines of Defense model involves several key steps:

- Establish Clear Roles and Responsibilities: Define and communicate the roles of each line – operational management (1st line), risk management/compliance (2nd line), and internal audit (3rd line). Each line should understand its specific responsibilities in risk identification, assessment, and control.

- Develop Policies and Procedures: Create comprehensive policies and procedures for risk management, compliance, and internal audit processes. These should align with the organization’s objectives and regulatory requirements.

- Training and Communication: Train employees across all lines to understand their roles and how they contribute to risk management. Clear and effective communication is crucial to ensure everyone understands the significance of their role in the model.

- Integration and Collaboration: Foster collaboration and communication between the three lines. Integration ensures a cohesive approach to managing risks, where each line supports the others while maintaining independence.

- Continuous Monitoring and Improvement: Implement systems for ongoing monitoring of risk activities and performance. Regular assessments and audits help identify areas for improvement and enable the organization to evolve and adapt to changing risks and regulatory landscapes.

- Leadership Support: Gain support and commitment from top leadership to reinforce the importance of the Three Lines of Model throughout the organization. Leadership backing is crucial for successful implementation.

By methodically following these steps, an organization can effectively implement the Three Lines Model, thereby enhancing risk management, compliance, and governance structures across the board. For a real-life example watch this video of a guest speaker from Centennial Bank describe how they conduct enterprise risk management with the Three Lines of Defense by using LogicManager ERM software.